Wave Mobile Money is now a buzz in Uganda, the Senegalese startup provides an app-based financial solution to save, transfer, and borrow money. The genesis of this product began in 2016 and was motivated by the fact that nearly 60% of adults in sub-Saharan Africa had no bank account.

Wave Mobile Money is based on building financial services to work as they should: no account fees, instantly available and accepted everywhere. In places where electricity, water, and roads don’t always function, the makers of the app were creating a financial infrastructure that “just works.” By late 2017, the mobile app in Senegal was launched for cash deposits, withdrawals, and peer-to-peer and business payments, and in July 2019, it launched in Cote d’Ivoire, and in 2021 launched in Uganda with the goal of making Africa the first cashless continent. The company is licensed by the Bank of Uganda as a Payment service provider.

But in Uganda, Wave Mobile Money is faced with huge competition from Airtel and MTN which are both leading this fintech domain with Airtel Money and MTN MoMo (Mobile Money) respectively. These have helped shape the evolution of mobile money from USSD to smartphone app (mobile money 2.0) with the introduction of their respective apps.

Wave Mobile Money Services

- Send money

- Withdraw

- Deposit

- Pay Utility bills (StarTimes, Yaka, Umeme, NWSC, DSTV, GOTV)

- Agent network

The Wave Mobile Money App & Account

Wave Mobile Money is as simple as they come, they are not a Telco but instead a money transfer service. You can have a Wave account with any mobile phone number (MTN, Airtel, and Lyca Mobile). Think of us as Whatsapp, an app that you can use on any of your phone lines.

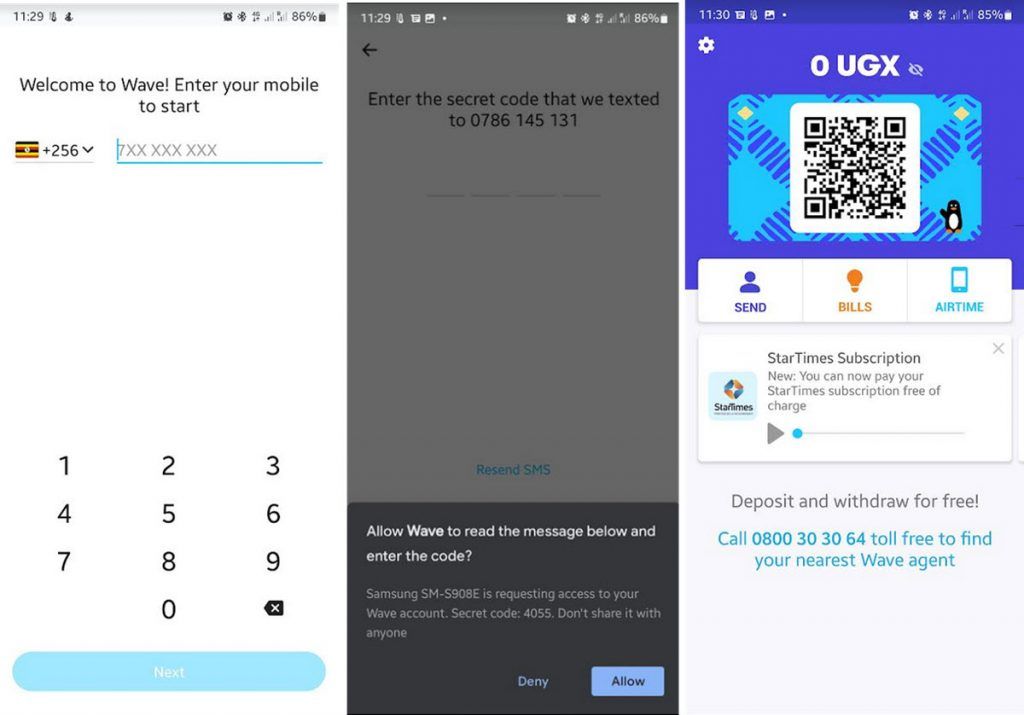

With the app, once downloaded from the App Store or Google PlayStore, you will be prompted to input your Airtel or MTN Number. You will be sent a secret code via SMS that will enable active your account. After inputting the secret code, you will be asked to create a four-digit password that will help keep your account secure. The app will also make use of your smartphone’s security features like fingerprint or face recognition. When all that is set up, you are good to go.

There are accounts limits with the service on the app. Users can at any one time have a maximum balance of UGX 2,000,000 and this same amount also applies to the maximum daily received transfers. When it comes to payments users can only payout up to a maximum of UGX 350,000 from one wallet to another.

Sending, withdrawal & deposit fees

For any mobile money service, it’s a basic to support sending money to loved ones. Wave mobile money charges a 1% fee when you are sending money from one Wave wallet to another and a maximum flat fee of UGX 12,500 for any transaction over UGX 1,250,000. When compared to MTN, you can send money for free to MTN MoMo registered customers using the MTN MoMo app irrespective of any amount. You can also send money to someone without a wave account. They will receive an SMS containing an 8-digit withdrawal code. But the sender must make sure the receiver has a valid ID. They will need to take it to an agent for withdrawal.

When compared to MTN MoMo charges, Wave MoMo charges are relatively cheaper when you are sending between UGX 500 and UGX 60,000. MTN recently reduced its transfer rates to other networks. here is a breakdown of the sending fees;

| Min | Max | MTN MoMo to MTN | MTN to other Networks | Wave Mobile Money |

|---|---|---|---|---|

| 500 | 2,500 | 30 | 330 | 25 |

| 2,501 | 5,000 | 100 | 440 | 50 |

| 5,001 | 15,000 | 350 | 700 | 100 |

| 15,001 | 30,000 | 500 | 800 | 300 |

| 30,001 | 45,000 | 600 | 1,210 | 450 |

| 45,001 | 60,000 | 750 | 1,500 | 600 |

| 60,001 | 125,000 | 1,000 | 1,925 | 1,000 |

| 125,001 | 250,000 | 1,100 | 3,575 | 2,500 |

| 250,001 | 500,000 | 1,250 | 7,000 | 5,000 |

| 500,001 | 1,000,000 | 1,250 | 12,500 | 10,000 |

When it comes to withdrawal fees, Wave mobile money is at UGX 0. This is different from the existing telecoms that have to charge clients both withdrawal fees and the 0.5% Mobile Money tax that is levied on the customer when they withdraw money from their Airtel or MTN MoMo wallets.

Just like banks, Wave MoMo allows customers to deposit money on their platform at zero cost with withdraws or service charges. This is also similar to existing mobile money platforms.

QR Code Card

We have mentioned that Wave MoMo relies on smartphones to do transactions, this means one needs a reliable internet connection. So what happens when there is no internet? Tradition telecom companies rely on USSD technology to offer the option for customers to withdraw or deposit money and pay utility bills when a user is offline or using a feature phone.

Card-only users do not have a PIN. Instead, they receive 4-digit authentication/validation codes via SMS that are

constantly renewed for their transactions every 5 mins or so.

Wave mobile money on the other hand uses a QR code on a card when there is no internet access. This allows for users without a smartphone to be registered and given a card with a QR code that they can use to deposit and withdraw money from their Wave MoMo accounts. The QR code cards can support all the services on the smartphone but the customer has to access them through an agent.

The Agent Networks and Availability

The success of MTN MoMo has been solely due to creating Agent networks countrywide which enabled the expansion of cashless services to a common Ugandan. This is the same success that Wave mobile money has to replicate in order to succeed. The company is investing in its agent network with over 7,000 agents across all regions of Uganda. Comparing them then MTN or Airtel is no real competition as you can’t fail to find an agent to withdraw or deposit your money from at the moment depending on your location. You can check the availability of a Wave agent near you using the Wave app or simply click this link`.