The Uganda Revenue Authority has taken the veil off its new platform branded as Kakasa. It is a set of government world-class certified smart business solutions introduced to ease doing business in Uganda, enable compliance, and ultimately increase Uganda’s attractiveness as an investment destination. Kakasa comprises of two business solutions namely:

Introducing Kakasa

Digital Tax Stamps

These are tamper-proof physical paper or numerical markings (see featured image) with security features and codes that are applied to goods or their packaging to prevent counterfeiting. Digital stamps enable;

• Manufacturers’ to track their products’ movement

• Government to monitor compliance of these manufactures

• Consumers to trace the origin and authenticity of these products.

6 excisable products are gazetted for initial implementation of these Digital Tax Stamps namely wines, mineral water, beers, spirits, soda, and tobacco products.

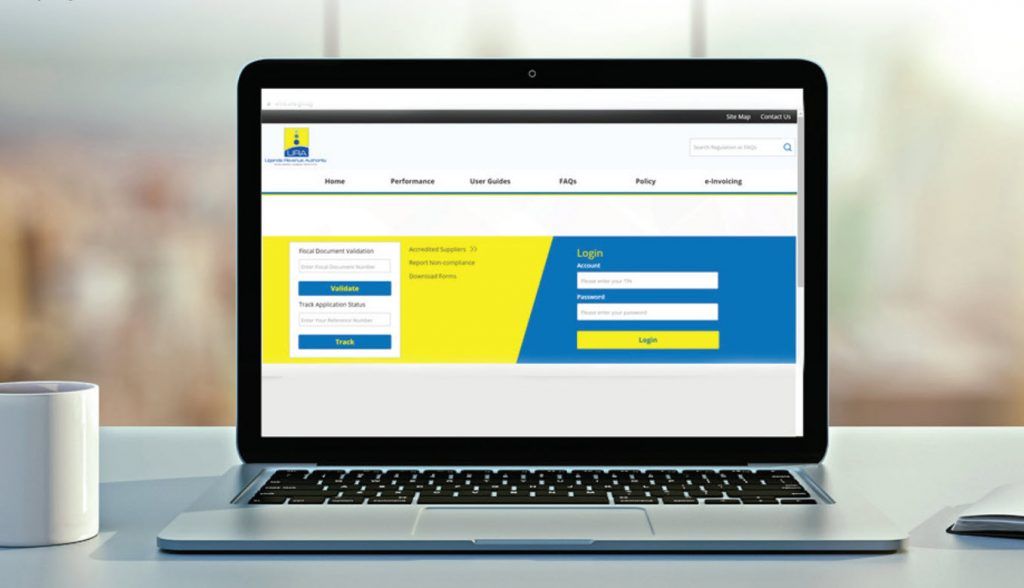

e-Invoicing

This is a process of formatting, sending and receiving of transactional details into fiscal data and fiscal documents (electronic invoices and e-receipts), storing of fiscal information and generating of fiscal documents in an electronic format which is printable on a need basis.

This is enabled by a software intermediary commonly known as Application Protocol Interface (API) specifying how the software components shall interact to allow the exchange of transactional information using the channels below;

• System to System connection.

• Client applications to be installed on a computer. (For taxpayers with or without system) and AskURA mobile application for taxpayers with mobile gadgets.

• Web portal. (For taxpayers with or without system)

• Send transaction details through USSD for the different mobile network suppliers.

ALSO READ: Why MTN doesn’t need to pay over UGX 24 billion worth of taxes URA ordered it to pay

Key features of the Kakasa Solutions

a. Track and trace capabilities.

b. Real-time exchange of production and transaction data.

c. Simplified bookkeeping to enhance business monitoring.

d. Quick access to information spanning years at the click of a button.

e. A comprehensive view of the business from inputs to the outputs.

Taxpayers

- Protection of the legitimate economy by guaranteeing fair competition through curbing illicit trade practices.

- Enhanced facilitation of taxpayers’ compliance through real-time access of their production/imports details which in turn enables auto-filled return filing.

- Improved business operational efficiency.

- Expedited tax disputes and tax refunds process.

- Simplified tax declaration process because of an available database to support the use of prepopulated tax returns.

- A platform and tool for proper record keeping with full details of real-time business transactions.

- Lower compliance costs

- Simplified processes (returns declaration, refunds management, registration etc.)

Consumer

- Enhanced public health by mitigating potential health risks caused by substandard/counterfeit goods.

- Empowered consumers make better choices prior to consuming products through the use of smart tools.

- Improved Fiscal-Social contract as citizen’s perception of taxation is improved because of raised visibility of Uganda’s tax system.

- Increased ease of business formalization which opens up more business opportunities.

- Increased promotion of fair competition and

- equitable taxation as counterfeits and illicit traders

- are cleansed from the Ugandan market.

Why URA introduced Kakasa

Kakasa is borne out of government’s desire to resolve the following taxpayer complaints;

- Lengthy and complicated tax administration processes.

- Complicated and lengthy declaration process.

- Inconsistencies in tax assessments and ledger positions.

- The requirement to store physical documents for not less than 5 years.

- Lack of proper bookkeeping knowledge and skills given the illiteracy levels in

Uganda. - Loss of transaction records.

- lack of clarity on what to expect at different intervals of consuming similar services by the same clients

- Inadequate information on the rights, roles, and obligations of taxpayers as well the

knowledge and skills to use the systems and procedures - Uneven playing field among taxpayers rising from counterfeits and illicit trade.

Who is to use the this Solutions

For digital stamps, the use of this solution shall apply to every person in the business of manufacturing and importing of products gazetted for the application of these Digital Tax Stamps. Initially, these are the manufacturers and importers of the 6 excisable

products under gazette.

The e-invoicing solution shall apply to every person carrying on business in Uganda under business models Business to Business (B2B), Business to Government (B2G), and Business to Consumer (B2C). However, the solution shall be piloted and rolled out in a phased approach as per the commissioners’ gazette.

Business Installation

A set of digital machines are installed at the manufacturer’s premises. These include the

applicator, the scanner that checks to see whether the product has a stamp affixed, the encoder that puts codes on digital imprints, the line enable, a server to store production data and enable exchange of information to URA and cabinets that store ink, spare

parts among other things.

The components that enable e-Invoicing are virtually installed at the business premises. This shall be in the virtual IT network or on the gadgets such as a computer used by the business to generate e-receipts or e-invoices. System to system shall be installed in the virtual IT network, the client application shall be installed on a computer and the askURA mobile application and a link embedded on the URA portal that can be accessed by businesses from anywhere as long as there is an internet connection.

How the solutions work

For the digital stamp, A stamp is affixed to every item manufactured in Uganda or imported. For the items manufactured in Uganda, the process is both;

- Manual: the stamp is put by hand on each item or packaging unit and then manually activated.

- Automated: stamps are affixed on the unit product while still on the production line after the unit product packaging.

For imports, a stamp is affixed in the country of export or at any place designated by URA. Upon activation, the stamps relay data to URA in real-time or near real-time. The stamp has a track and trace capability from the point of production to the point of distribution.

For e-Invoicing, once a transaction is initiated using any of the solution components, transaction details are transmitted to URA’s back end system f or fiscalization

and thereafter produce e-invoices or e-receipts with special features that are sent back to the solution component at the business premise for issuance to a customer in real time.