The latest telecom sector market performance report from the Uganda communications commission indicates that telecom companies registered a record new 1.8 million subscribers in 2020 between January and March.

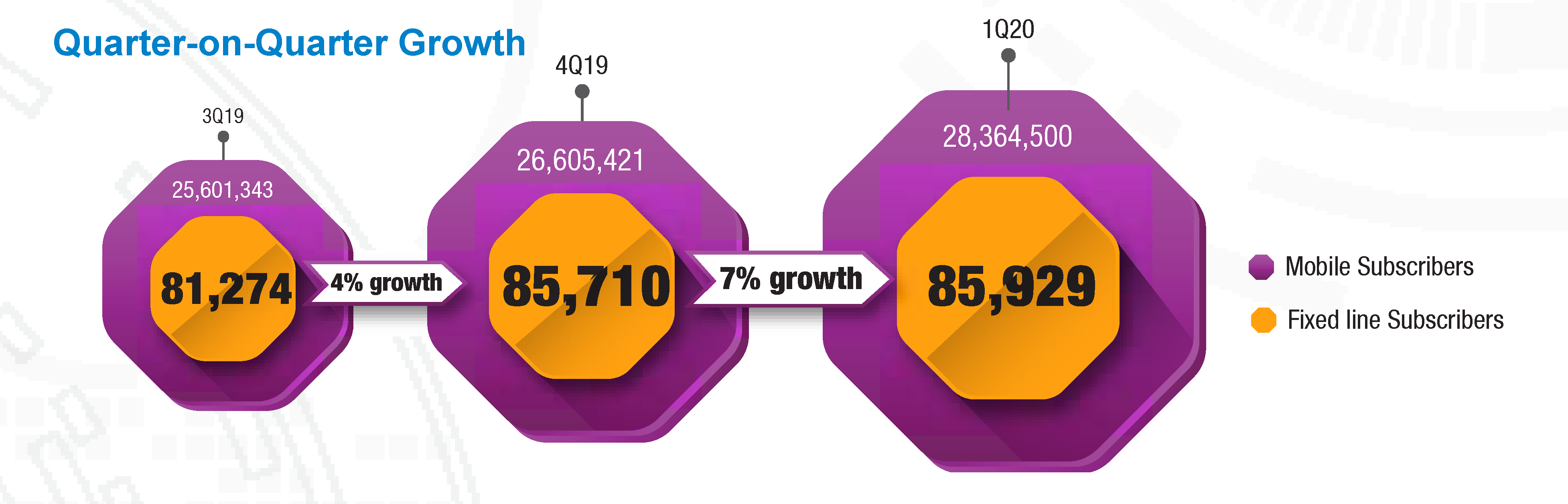

This rise now means that mobile subscriptions have increased to 28.4 million at the end of March 2020, up from 26.7 million three months earlier, representing a 7% quarter-on-quarter growth.

UCC now puts the telecom national teledensity at 67%, having grown from 66% at the end of December 2019. This shows that telecom companies were not affected by the COVID-19 pandemic effects.

ALSO READ: How some telecom firms are ‘minting money’ in this quarantine period

These telecom indicators, the report states, could in part be attributed to the onset of COVID-19, which made it imperative to work from home, online classes, as well as many Ugandans returning home from abroad.

Data usage increased

As telecom mobile subscriptions grew exponentially during the period under review, so did internet subscriptions, which rose from 16.9 million to 18.8 million during the same period. This leap was in line with the yearly trajectory, which saw total internet subscriptions grow by 31% over 12 months (March 2019 – March 2020).

Mobile devices continued to stand out as the internet access medium of choice, accounting for more than 95% of new growth during the quarter. At the end of the review period, mobile internet subscriptions accounted for 99.6% of all internet subscriptions.

“The new growth in internet subscriptions and internet-enabled hardware on the market translates into an internet penetration of 45 internet connections per 100 Ugandans,” the report says.

Indeed feature phones with basic internet telecom access and smartphones remain the driver of the new mobile internet subscriptions, having grown from 23.8 million devices in December 2019 to 24.4 million in March 2020.

Growth in mobile financial services

Registered mobile money accounts grew by almost 700,000 users during the quarter, from 24.7 million registered accounts in December 2019 to 25.4 million in March 2020.

Of these, 21 million accounts undertook at least one billable mobile money transaction in the 90 days preceding March 31, 2020. As it is, for every two Ugandans, at least one has an active mobile wallet on their respective telecom networks.

“While registered accounts grew at only 0.9% during the quarter, the growth in active mobile money accounts averaged 4% during the same period,” industry telecom report states, pointing out that seventy-five (75%) of the new transactions were on previously dormant accounts.

OTT numbers increase

Highlighting growth in usage of Over The Top (OTT) services (such as Facebook, WhatsApp, and Twitter), the industry telecom report reveals that at least 10.63 million users accessed OTT services at least once during the month of March 2020, compared to 10.16 million users during the month of December 2019. This represents a growth rate of 5%.

Growth in telecom revenues

To top it all off, the telecom sector posted the highest quarterly revenues recorded, crossing the UGX 1 trillion mark in total quarterly earnings for the first time. At the end of the previous quarter (December 2019), the figure was UGX 937.4billion, representing a quarter-on-quarter growth of 12%.

The revenue lines under consideration include retail and wholesale revenues such as tower lease sales, international bandwidth, mobile financial services, as well as voice and data services. It is worth noting that the share of mobile data with respect to total sector revenues grew by a factor of almost 2%.

However, as total revenues in the telecom sector rose, so did the monthly cost of service, which jumped from UGX 230 billion to UGX 238 billion during the same period. The cost of service incorporates expenses on input/wholesale services, salaries, taxes, and depreciation, among other key metrics.