Netflix is slowly killing DStv in Africa by being customer-centric, this is a fact –despite DStv’s edge in live sports broadcasting. When it comes to content Netflix has its own original shows, unlike DStv that relies on buying content and partnering with other broadcasters. According to futurist Craig Wing;

“DStv got killed by Netflix because of its high prices, lack of new content, and forced adverts, Technology and business models are not the biggest disruptors. Not being customer-centric and creating for users is the biggest threat to any business.”

ALSO READ: Here is what MultiChoice Uganda is doing about the annoying repeats on DStv

This is also true for other industries too, the way Uber and Safe Boda have disrupted the car and motorbike ride-sharing industry, iTunes disrupted CD stores, Amazon is disrupting physical retail, and how Airbnb is disrupting the hotel industry worldwide. In this case, it’s clear that Netflix is the old guard, which explains their recent partnership with Netflix to lure its subscribers to use their decoders to also watch Netflix.

Netflix launched around the world in January 2016, including Uganda, bringing a dramatic halt to MultiChoice’s unchallenged growth in the premium video entertainment space. The biggest issue for Netflix’s adoption is the exorbitant data charges that limit users from consumers enjoying the service. As years have passed, the data bundles are getting more affordable, and more households are going for home broadband solutions which were mainly accelerated by the recent lockdown.

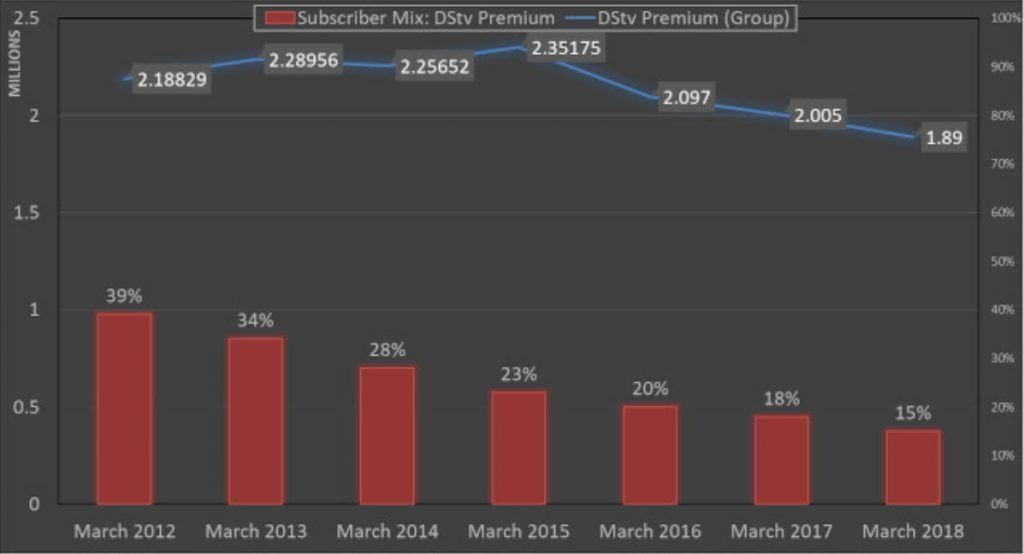

On the continent, the first indications of Netflix’s effect on MultiChoice’s DStv Premium offering came from Naspers’ financial statements in 2016, which showed that there was a dramatic slowdown in new DStv Premium sign-ups. In 2018, Naspers finally reported that DStv was losing Premium subscribers.

ALSO READ: Google statistics confirm that Ugandans are actually adhering to the quarantine

Recent stats show that MultiChoice had been losing DStv subscribers since its 2015/16 financial year affecting Premium, Compact, and lower-end packages—across its entire African operation.

It should be noted that while MultiChoice’s DStv Premium packages suffered after the launch of Netflix across the African continent, its overall subscriber base continued to grow.

DStv Subscriber decline

The chart below shows how DStv Premium subscribers in Africa declined between 2015 and 2018, according to figures reported in Naspers’ annual results.

It is currently not possible to directly compare these figures to those for 2019 and 2020 because MultiChoice recently changed the way it reports subscriber numbers.

After the unbundling, MultiChoice started reporting a “Premium subscribers” figure, which is actually a combination of DStv Premium bouquet and DStv Compact Plus bouquet subscribers. As a result of this change, MultiChoice is now reporting subscriber growth across all its operations in Africa for its premium segment.

In other words, DStv Compact Plus is growing enough in the rest of Africa to offset those DStv Premium subscribers canceling their packages.

In 2019 and 2020 MultiChoice finds its self in a catch-22 situation that has forced it to change the way it counts subscribers. The number of premium subscribers continues to decline, as illustrated in the table below which shows the total subscribers across all the regions in which the MultiChoice group operates.

| Year | DStv subscribers at 31 March | 90-day Active DStv subscribers | DStv Premium subscribers on 31 March | DStv Premium and Compact Plus subscribers on 31 March | 90-day Active DStv Premium and Compact Plus subscribers |

|---|---|---|---|---|---|

| 2012 | 5,611,000 | – | 2,188,290 | – | – |

| 2013 | 6,739,000 | – | 2,291,260 | – | – |

| 2014 | 8,059,000 | – | 2,256,520 | – | – |

| 2015 | 10,225,000 | – | 2,351,750 | – | – |

| 2016 | 10,411,000 | – | 2,097,000 | – | – |

| 2017 | 11,942,000 | – | 1,962,000 | – | – |

| 2018 | 13,476,000 | 16,400,000 | 1,921,000 | 2,400,000 | – |

| 2019 | 15,097,000 | 18,600,000 | – | 2,500,000 | 2,600,000 |

| 2020 | 15,743,000 | 19,500,000 | – | – | 2,700,000 |

Netflix revenues soar

In the 2019 financial report, Netflix revenues in the region increased from USD 2.3 million to USD 4 million in 2017 to 2019 respectively, almost doubling its revenues. Paid streaming memberships between 2018 and 2019 have slightly grown from 37,601 to 47,355 which seemed to be a bit disappointing considering the clout around the streaming service. Given the fact that Netflix allows password sharing these numbers don’t seem to be as huge as one would expect.

| Year | Revenues ($) | Paid net streaming membership additions | Paid streaming memberships | Average paid streaming memberships |

|---|---|---|---|---|

| 2017 | 2,362,813 | 8,173 | 26,004 | 21,476 |

| 2018 | 3,963,707 | 11,814 | 37,818 | 31,601 |

| 2019 | 3,980,506 | 9,537 | 47,355 | 43,119 |

More than half of Netflix’s 158 million global subscribers and 90 percent of its growth now come from outside the US. Since the first quarter of 2017, the Europe, Middle East and Africa region has seen a 140 percent increase in subscribers. The number of Netflix subscribers in the Asia-Pacific region has more than tripled in the same time, and Latin America now has 29.4 million subscribers, up from just 15.4 million in the first quarter of 2017.