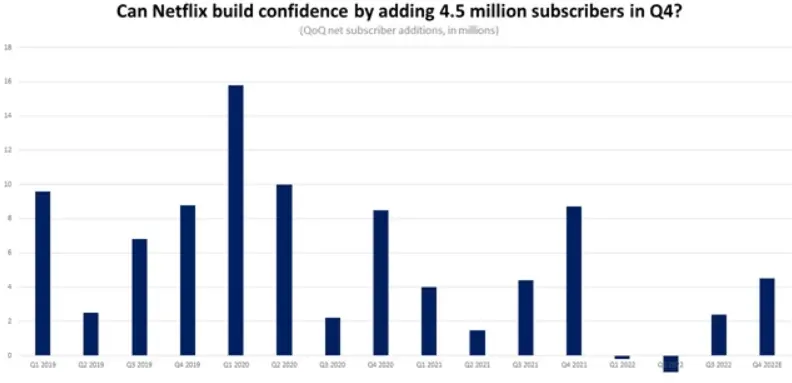

Netflix has made 16 years this week and later this week will release its fourth-quarter financial report after the market closes on Thursday, January 19. The company is expected to add 4.5 million new subscribers in the fourth quarter of 2022.

ALSO READ: How to jot down personal ideas on WhatsApp

The popular streaming company’s subscriber growth has been uneven and erratic in recent years. The high growth during the epidemic could not be maintained, and the first decline in the company’s history occurred. This caused its stock price to fall by more than half in 2022. Netflix added 2.4 million subscribers in the third quarter of 2022 and said it expects to add 4.5 million in the fourth quarter. If achieved, the number of subscribers would reach a record 230.25 million. However, 4.5 million is still the weakest growth since 2014 and would be down sharply from a year earlier.

.

Netflix’s revenue increases slightly

Predictions by Wall Street indicate that Netflix’s fourth-quarter revenue will increase by 1.6% year-on-year to $7.83 billion. This is higher than the company’s expected $7.78 billion. Its key earnings metric, operating income, is expected to fall 43% from last year to $362.4 million. However, its diluted earnings per share will plunge nearly 70% to $0.41. Still, the consensus was above expectations for Netflix’s quarterly operating profit of $330 million and EPS of $0.36. Currently, Wall Street sees Netflix adding 14 million subscribers in 2023, up 5.8 million from its 2022 plan. However, this is still one of the slowest growth in the past decade. The average revenue per user which will become a more important measure for assessing the impact of its new pricing tiers is expected to continue rising to record highs this year. The increase is driven by higher ad revenue and higher prices.

Netflix’s revenue is expected to grow by more than 7% in 2023 due to faster subscriber growth. Netflix has said it aims to achieve double-digit revenue growth over the long term, but the market doesn’t think it will happen until 2024. Earnings will fall in 2022 for the first time in seven years, but growth is expected to return in 2023, with operating profit expected to jump more than 11% and lead to a modest 2.9% increase in EPS.

.