On 1st July 2018, the Government of Uganda introduced the Over the top (OTT) TAX in a bid to curb social media misuse, increase the tax base among other reasons. The tax was met with a lot of resistance and protests –with most of the tax experts categorizing it as a double tax that wouldn’t work and on the other hand, the tech-savvy had several solutions to evade it. Three years down the road, this is all about to change.

ALSO READ: Here’s why OTT tax subscriptions and revenues will continue to decline

VPN wins OTT battle

The Social Media tax was levied as excise duty on over-the-top (OTT) services where users would have to pay a UGX 200 levy per day of access, UGX 6,000 per month, and UGX 73,000 per year. But this has all failed as the Government recently admitted that this tax was not collecting the expected amounts and decided to tax the internet directly at a higher 12% rate. This marked the death of OTT but how did we get to this stage?

There had clearly been a cat a mouse game between the government and its citizens when it came to paying this tax. As they had solutions like the use of VPNs to evade this tax, In fact at Techjaja, we had already predicted that this was a war that the government wouldn’t win. At some point, the state started adopting the use of VPN in virtual court cases making it hard for them to stand highon the moral pedestal.

ALSO READ: Govt uses Video Conferencing technology in Courtroom for Bobi Wine’s OTT case

The Friction

The tax was so disliked that even the MPs wanted the government to pay it for them as of June 2019. Rt Hon Rebecca Kadaga, the former Speaker of Parliament stuck to her guns and blocked the contract that would see the government through the Parliament pay the Over the Top (OTT) tax for the MPs. Parliament had made a deal with MTN Uganda to pay the tax calculated at a monthly rate of UGX 6,000 and provide 5GB data bundles for each of the 458 legislators.

In a lengthy Facebook post, written on 26th July 2019, by the former ICT Minister Hon Frank K Tumwebaze where he unveiled how the removal of the OTT wouldn’t influence data prices which is contrary to what is going to happen. “Ever since this tax was introduced, it was bound to fail,” he said. He also disclosed that his ministry at the time had been fighting this tax internally with the ministry of finance, in vain but also felt that if this tax would be removed it would good as it would increase the rate of internet penetration in the country.

ALSO READ: Speaker to ‘fight’ MTN Uganda’s contract to supply free internet and OTT services to MPs

By January 14, 2020, the numbers from URA indicated that only UGX 4.4 B collected was Social media Tax as of July 2019 of the projected UGX 8.3 billion. Government’s yearly target was to collect UGX 100 billion and was UGX 52.8 billion away from realization if this trend continued.

Inaccurate tax projections

While appearing before the Parliamentary Finance Committee presenting the budget framework paper for the Financial Year 2020/2021, the former URA Commissioner General Doris Akol proposed to the committee that the failed OTT tax should instead be imposed on data bundles to avoid tax evasion using VPNs. This seems to be the solution that the government has finally adopted by imposing the 12% tax directly on all data bundles.

One didn’t have to be an economist to see that this tax was counterproductive and wouldn’t fetch the projected revenues. Fortunately, the market always exposes the thoughtlessness of such decisions which it has done.

Without mincing words its is clear that the initial forecasts of this tax was based on widely inaccurate estimates. This included stats like the industry statistics on the number of internet subscriptions. Secondly the figure needed to have been arrived to after knowing Uganda’s DAU (Daily Active Users) per OTT platform. At UGX 49.6 Billion it meant about 700,000 users per the tax per day over the course of 365 days, moving that number to 1 million users (OTT Tax Payers) would give them a good cushion. The UGX 284 bn projected figure at the time was always going to be a tall order for the tax base to handle.

The Covid effect

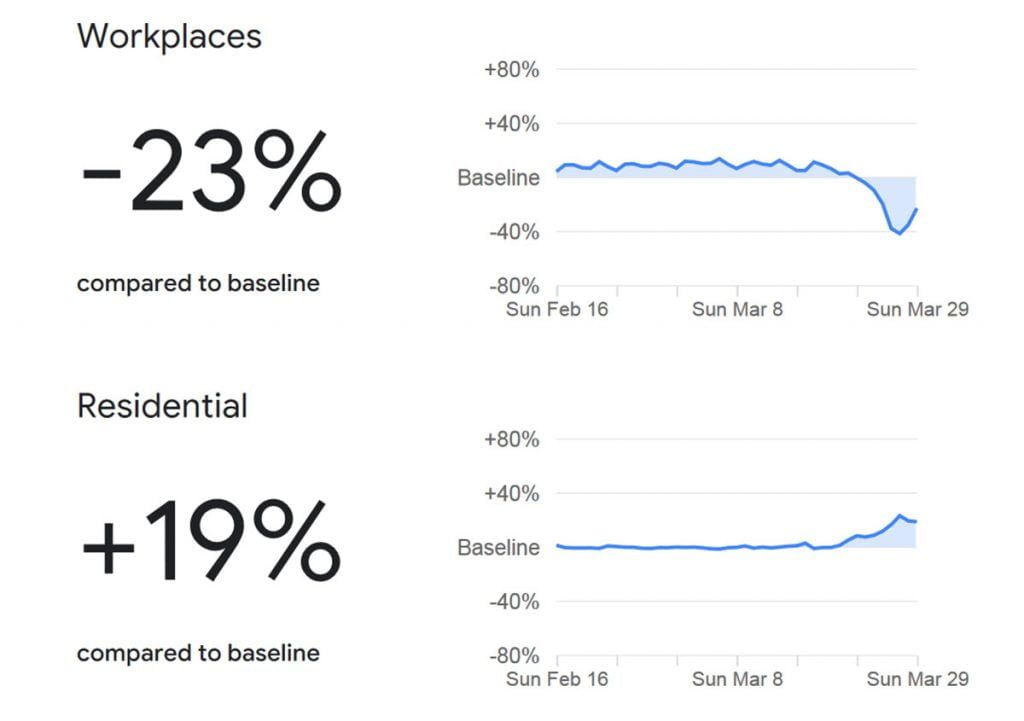

We are now in the second wave of the Covid-19 pandemic in Uganda, but during the first lockdown, some of the measures for curbing this virus such as having people work remotely, students study at home and an increased reliance on digital transactions, were all hindered by Uganda’s social media and the mobile tax.

A study was conducted by Pollicy on March 23, 2020, on the second OTT tax report titled “A Shot in the Dark: The Impact of the Social Media Tax in Uganda on Access, Usage, Income, and Productivity”. According to the findings from the new report. there was a significant drop in social media usage and around 42% of the respondents felt that the tax is unfair. Around 36.4 percent of the respondents were accessing social media platforms more than 10 times a day prior to the tax, which number had dropped to 12.3 percent after the taxation at the time of the study.

This study was conducted on 1,188 respondents living in areas of Gulu, Jinja, Mbarara, and Kampala, with about 58% of them identifying as male and the remaining 42% as female. A majority (78.5 percent) of the participants were under the age of 35.

Overall, findings from the report showed that the OTT tax had continued to be unfair towards many groups and have reduced internet access, as well as productivity.

The report recommended the government to consider Scarping the tax as it was largely regressive and the need to use these taxed services is much greater now with the ongoing coronavirus pandemic limiting travel and encouraging people to adopt new remote working strategies.

Ban on Social Media

Social Media in Uganda had been under general lockdown since the eve of the January 14th, 2021 general elections. Since the OTT tax was mainly imposed on the Apps that the government had blocked, it was like it was shooting itself in the foot. By February 10, 2021, the Government partially lifted the ban on some social media sites apart from Facebook until now. The govt vowed to maintain the ban on Facebook until the security operatives were satisfied with the political situation and the ability for social media to maintain the status quo once open. Since the most used Social media platform used in Uganda is Facebook many people resorted to using VPNs in order to use the service.

At the time when the social media sites were banned, the govt believed that the citizens would be happy that social media was shut down to ensure their safety. This came at a time when the majority of Ugandans including government agencies, MPs, and civil servants were already using these online social platforms by utilizing VPNs to bypass their own restrictions. The ban not only affected social media businesses, but also the government’s ability to collect OTT taxes.

Telecoms were never affected

The telecom sector market performance report from the Uganda communications commission indicated that telecom companies registered a record new 1.8 million subscribers in 2020 between January and March.

The regulator’s report highlighted slow growth in usage of Over The Top (OTT) services (such as Facebook, WhatsApp, and Twitter), the industry telecom report revealed that at least 10.63 million users accessed OTT services at least once during the month of March 2020, compared to 10.16 million users during the month of December 2019. This represented a growth rate of 5%. However, at the end of the day all OTT tax charges were pushed back to the users leaving the telecoms unaffected.

Higher data prices

Moving forward, there is no doubt that effective 1st July 2021 you will have to revise the way you use your data. All telecom companies will remove all OTT tax options from thier services but also introduce the 12% duty on all data bundles. Internet data users are yet to he hit with new tariffs from their respective telecom companies.

What do you think about the new data tax? Leave us a comment below.