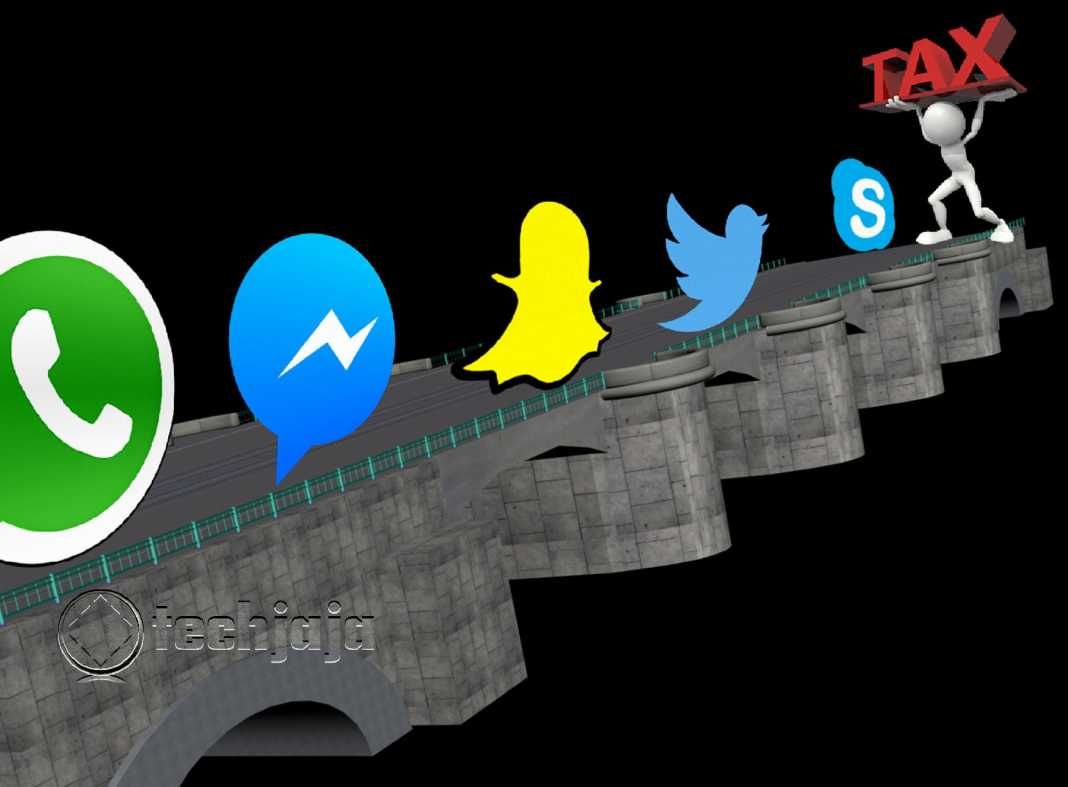

When it leaks, it pours! The leaked letter from the President of Uganda, Yoweri Kaguta Museveni to the Ministry of Finance has got social media users and humanitarians up all night trying to fight off what they consider an outrageous economic move to tax social media usage in Uganda. In the letter that has since made several rounds on all social media platforms, the President suggested a “small fee” of UGX 100 to be charged on every SIM card that accesses social media platforms like Facebook, Twitter, WhatsApp, Skype, among others. The President calculated that it could raise up to UGX 400 billion of additional revenue. So if government ever decides to tax social media, we believe these are the ripple effects that are likely to come out of this decision.

To most Ugandans, social media is the “Internet”. Internet penetration is calculated at 31.3% of the population. Taxing social media usage would derive some positive returns, but also bring along drastic consequences. The after effects of taxing social media usage in Uganda include:

1. Stunting Internet penetration

The percentage of Internet users in Uganda is still very low at 31.3%. Of this percentage, a large chunk of it uses the Internet for social media. Imposing a tax on it, however low it may be, will deter people from joining the social media platforms.

2. Drop in social media users

The only way to prevent being tasked is keeping away from the taxable activities. Levying social media usage would discourage people from using the platforms drastically reducing the number of social media users.

3. Advertisers will see a reduction in ads reach

Social media advertising is employed by many large and SME businesses to reach their customers and gain new ones. A reduction in social media users meaning the advertisers will only reach out to a few people which is bad for business.

4. Data might become expensive

The good current days of very affordable data bundles from telecom companies might as well wane with the introduction of a tax on social media. Telecom companies might want to make up for the reduction on Internet bundle buyers, or might want to compensate if they choose to pay the tax for each of us. This will lead to expensive data bundles that we had left for the history books.

5. We could go against net neutrality

Net neutrality is the principle that governments should mandate Internet service providers to treat all data on the Internet the same, and not discriminate or charge differently by user, content, website, platform, application, type of attached equipment, or method of communication. Putting a special tax on any part of social media usage may result in telcos charging differently on bundles that involve use of these platforms.

6. The rise of conspiracy theories

This has already started, even before the tax is established. Busiro East lawmaker, Hon. Medard Ssegona has said that Museveni wants to tax social media because he is scared of the very many political discussions that take place on social media. “The President is trying to discourage people from the use of social media so that they don’t interfere with his rule, interfere with his villagers, and trying to make sure they don’t get news about him“, he said. A lot more has been said.

7. The rise of local platforms

Last year, UCC announced that they were developing local Facebook and Twitter alternatives. Taxing social media platforms will discourage people from joining them and even lead some into dropping them. Because of the need to communicate cheaply, they will resort to local platforms which may not be taxed to allow their growth.

8. Better countrywide connectivity

Minister Frank Tumwebaze explained that the tax revenue from social media platforms would be used to invest in connectivity across the country to further expand the sector. The government Envisions tapping this money so that people from upcountry can also enjoy the benefits of better connectivity.

Can you know of any other outcomes of taxing social media apps in Uganda? Feel free to leave a comment below.