The Ugandan Communications Commission (UCC) has released its 2018 report on the state of Uganda’s communication industry and its shows growth in several sectors of the industry from voice, mobile internet, fintech, TV broadcast and postal service.

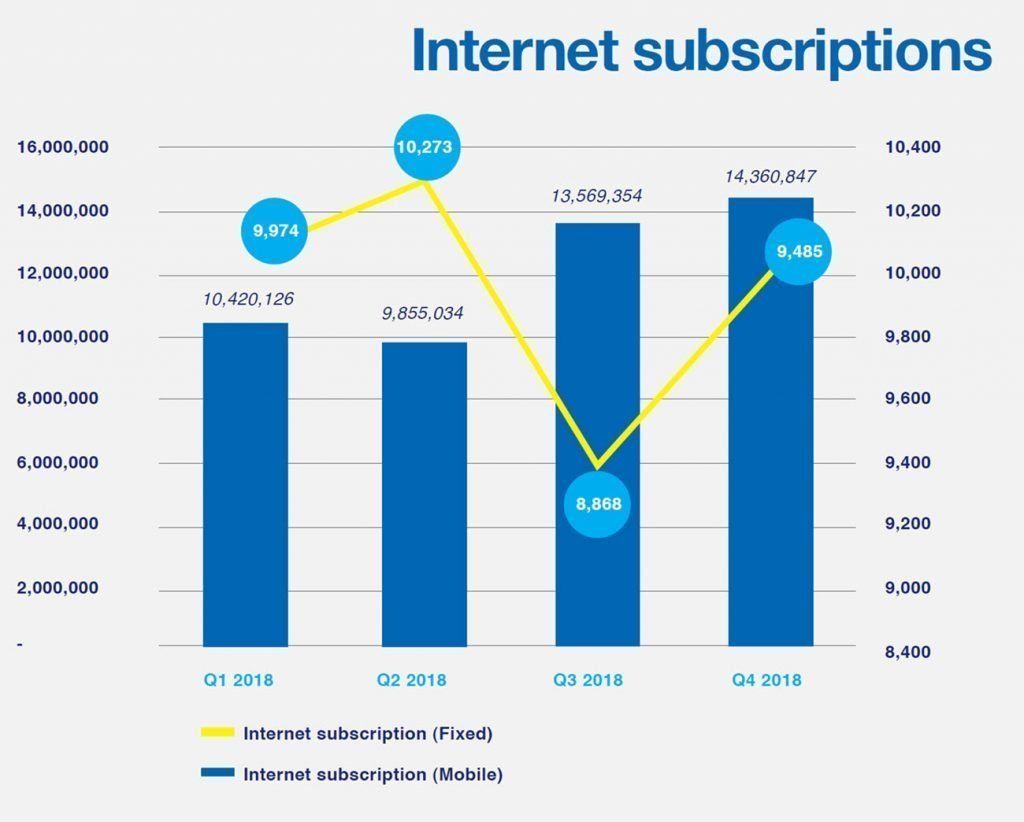

The Uganda internet market is dominated by mobile internet. The mobile internet subscription now stands at 14,360,847 up from 13,569,354 reflecting a growth of 5.8%. The total market (this includes both Over the Top OTT and web access) internet penetration now stands at 37%.

In UCC’s 2017 report, it was found that 64 percent of Ugandans were using mobile phones and mobile internet subscription had grown by 14.5 percent since March 2017. UCC attributed this growth is attributed to the stiff competition in the retail broadband market and lower costs of internet for handheld services.

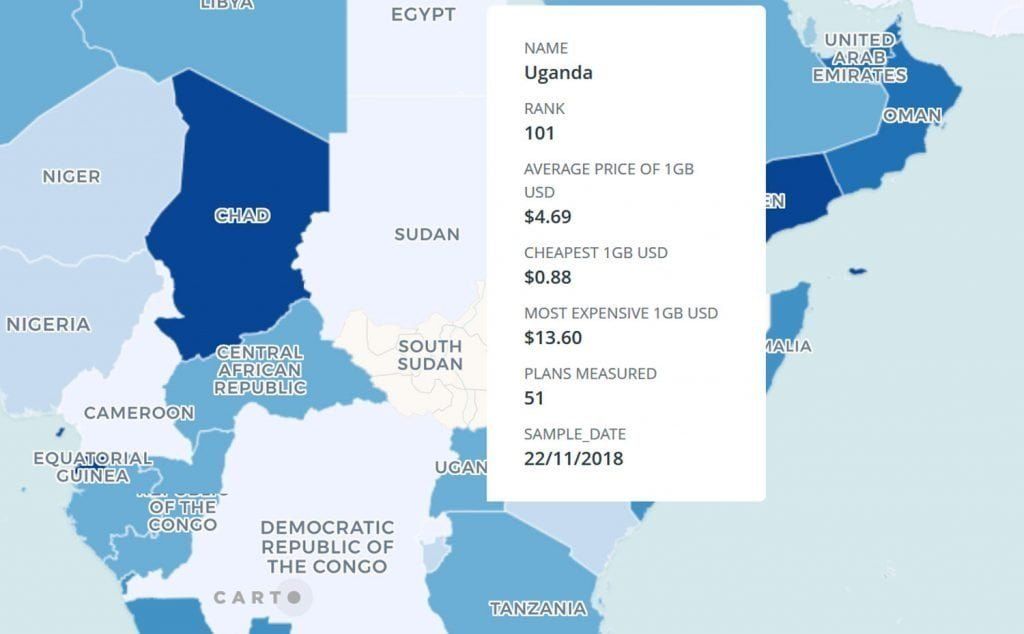

Cost of Mobile Internet in Uganda

A recent GSMA report indicated that out of the 230 countries, Uganda is in the 101st position worldwide and 23rd in Africa in regards to the most cheapest mobile internet worldwide right behind Madagascar.

Out of the 51 data plans measured, Uganda’s cheapest 1GB data package costs UGX 3.3k ($0.88) and can be as expensive as UGX 51k ($13.6). Rwanda, Congo, Kenya, Nigeria and Sudan take the top 5 spot respectively with their cheapest data ($0.04 to $ 0.29) .

Growth in number of smartphones and OTT growth

UCC’s report further indicates that the total number of smartphones in the market grew by 14% in the period Q1 to Q4. The number of smart phones in the market was 4,572,648 in Q1 to 5,219,729 by end Q4. Also the number of Base Transceiver Stations ( grew by 0.9% in Q4 and now stand at 4,903.

The total number of towers owned grew from 0.9% leading to increased network quality of service.

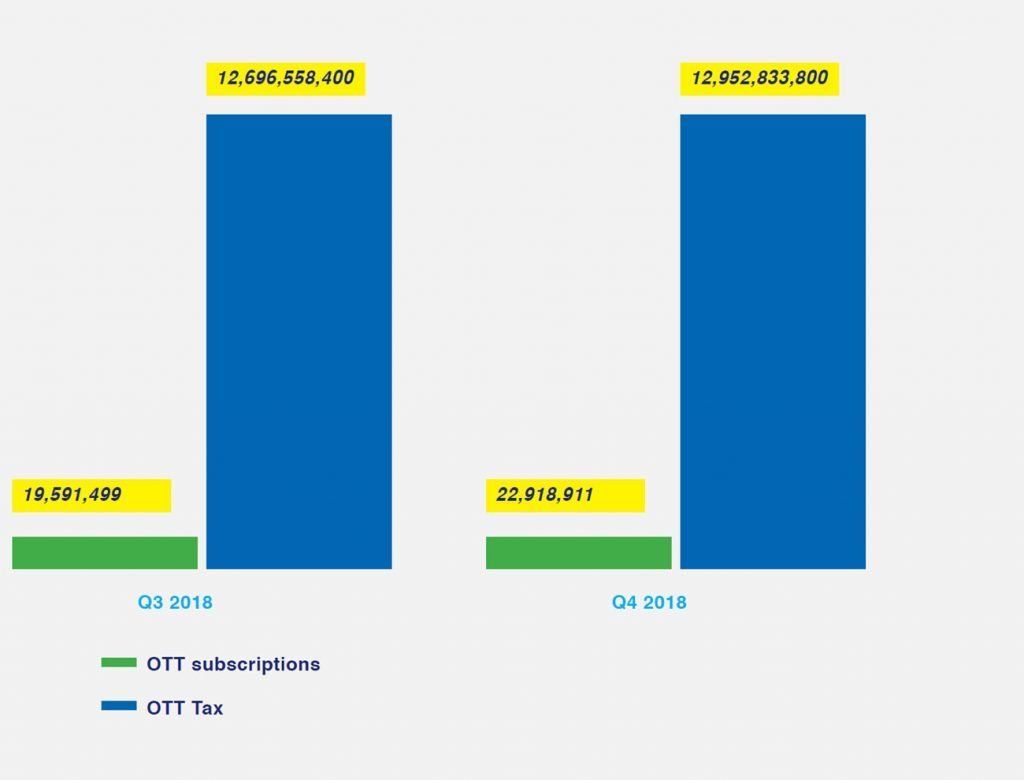

According to URA, Q3 to Q4 variations show that both the OTT subscriptions and the OTT tax revenues grew by 17% and 2% respectively. This figures are reflective of those who have used OTT services at least once in the quarter.